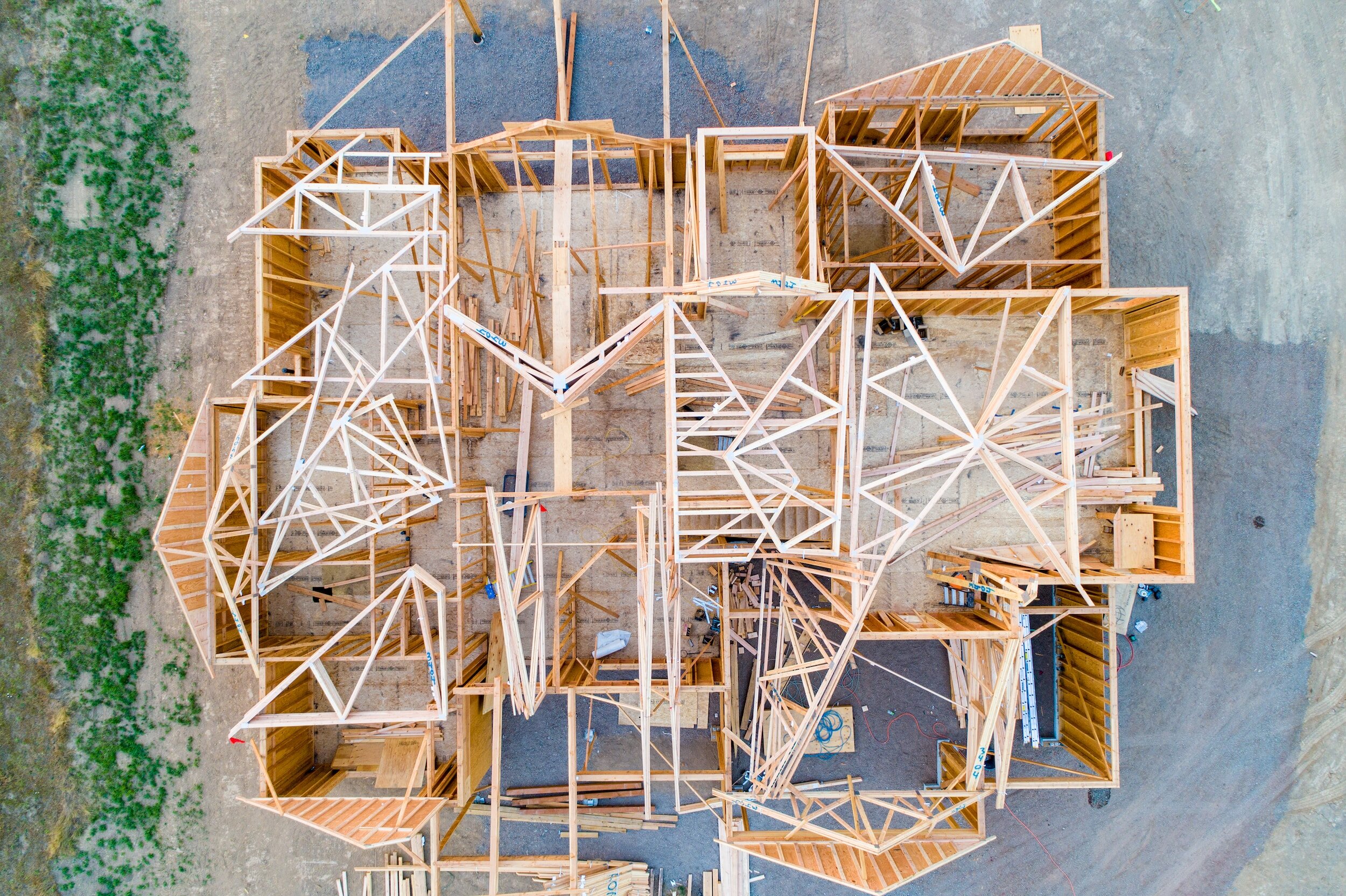

Uncovering Hidden

Opportunity

Strategically Designed Plans

-

Built for Your Team

We build retirement plans for the people that use them. Our participant centered approach is focused on your company’s most valuable resource.

The culture you’ve worked so hard to build should be reflected in your plan. From plan design to executive benefits, see how our experienced team can uncover hidden opportunity.

-

Built for Your Family

Navigating the world of finance is challenging endeavor. Our wealth management consulting process is focused on your priorities and optimizing a plan that works for you.

You don’t have to go it alone. When it’s time for an initial plan or a second opinion, let’s put our creative planning to work for you.

Pointer Financial Group is an independent, fiduciary advisory firm focused on retirement plan consulting and executive wealth management.

Expert advisors, loyally serving our clients, with altruism as our primary motivation. These core values are drivers of both our internal culture and the principles by which we serve clients.

Need some pointers? Subscribe to our newsletter.

Sign up with your email address to receive news and updates.

Our Advisors Are Here For You.

-

Proven track-record.

Our client-first emphasis and focus on successful outcomes creates long term relationships between clients and their advisors. We’ve focused our business on treating clients like family and have decades of experience in helping them attain their goals.

-

Subject Matter Expertise

We strive for both depth and breadth of knowledge in order to cultivate expertise on the specific topics affecting you. We take a multi-disciplinary approach partnering with both ERISA attorneys and CFA Charterholders to develop a team that capable of handling your most complex questions.

-

Collective Wisdom

As the saying goes - two heads are better than one. When you work with one member of our team, you get the entire team. We work to ensure that clients benefit from the research, strategies, and experience of our entire team and network of professionals.

Professional Designations and Industry Affiliations

We are committed to professional standards, ethics, and ongoing education. Our tools and resources are drawn from the most sophisticated available and enable us to leverage both technology and community to better serve our clients.

Have questions?

We have answers.

The best way to get your questions answered is to reach out to us. We can walk you though everything we do and provide a no-pressure second opinion. We might even answer some questions you didn’t even know you had.

See what hiring a true partner can do for you.

-

Retirement plans have a myriad of documents, disclosures, and disclaimers. Get in touch with us and we’ll send you a full document checklist to help us start to asses the health of your plan.

We’ll look for items like your 408(b)(2) disclosure, asset statement and plan document. If you’re not sure where to find those documents, we can provide you step by step assistance locating every document you need.

-

It can definitely be confusing. All of these are different types of fiduciaries your plan can hire.

3(16) refers to an administrative fiduciary who helps over see plan functions.

3(21) is an investment fiduciary who works with your plan committee to advise and consult on your plan investments.

3(38) is also an investment fiduciary, but one that takes discretionary authority of your investment selections.

They each can alleviate some of the fiduciary responsibly from your team and improve the overall plan function and design.

-

We work with businesses of all sizes. Many retirement plans are only available or are best suited to small businesses.

We can help identify if a Simple IRA, SEP IRA, 401(k), Solo 401(k), or other type of plan is right for your business.

-

Yes. Our wealth management team works with people with a variety of backgrounds and financial situations.

Get in touch with us and see what we can do for you!

-

Our Pointer is a true partner: A well-trained expert, loyal to the core, with a heart of gold. Pointers are able to canvass wide areas and point out hidden opportunities. They’re not only tireless workers, but great companions along the way.

What better image is there to remind us of the way we serve clients day in and day out?

Let us know how we can be of service to you.